28 Jul 2022

Australian Consumer Price Index (CPI)

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

Overnight, Jerome Powell the Chair of Federal Reserve of the United States increased official interest rates by 0.75% for the second month in a row which has lifted the federal funds rate to 2.25% to 2.50%.

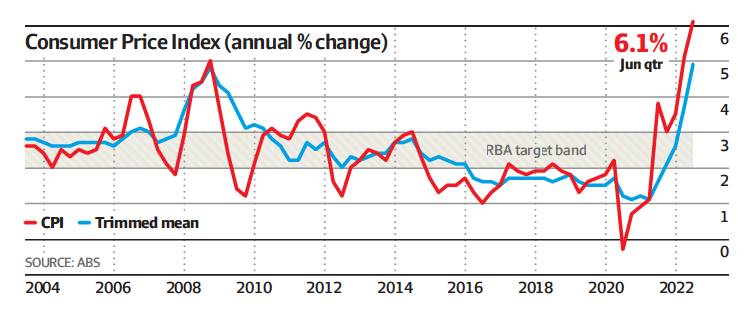

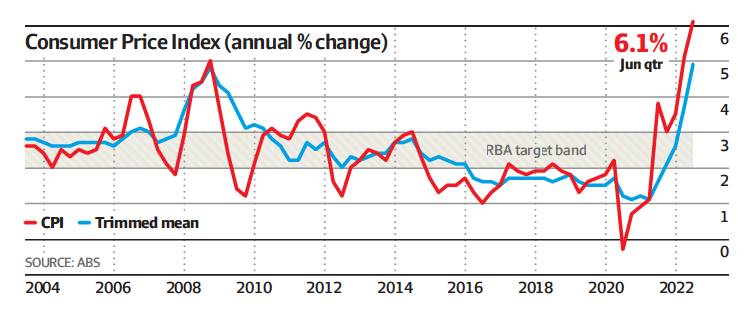

In Australia, the inflation rate increased to 6.1% for the year end 30 June 2022 (see chart above) and GDP grew 3.75% which was less than the forecast 4.25% but still positive.

Increased inflation plus positive GDP growth together with a 3.5% unemployment rate means that RBA will continue to increase the Cash Rate and lenders will continue to increase interest rates.

The positive outcome is that while this is happening, asset prices have been increasing over the past 3 to 4 weeks which could mean that the current market correction has ended.

Yes, it is true that we don’t actually know what Mr Market is thinking and will continue to wait and react if asset prices crash during this current period.

Right now the best course of action is to just remain invested according to your appetite for volatility and continue to buy more quality assets at discounted prices.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.