12 Sep 2022

Recession Indicator: United States (Part 1)

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

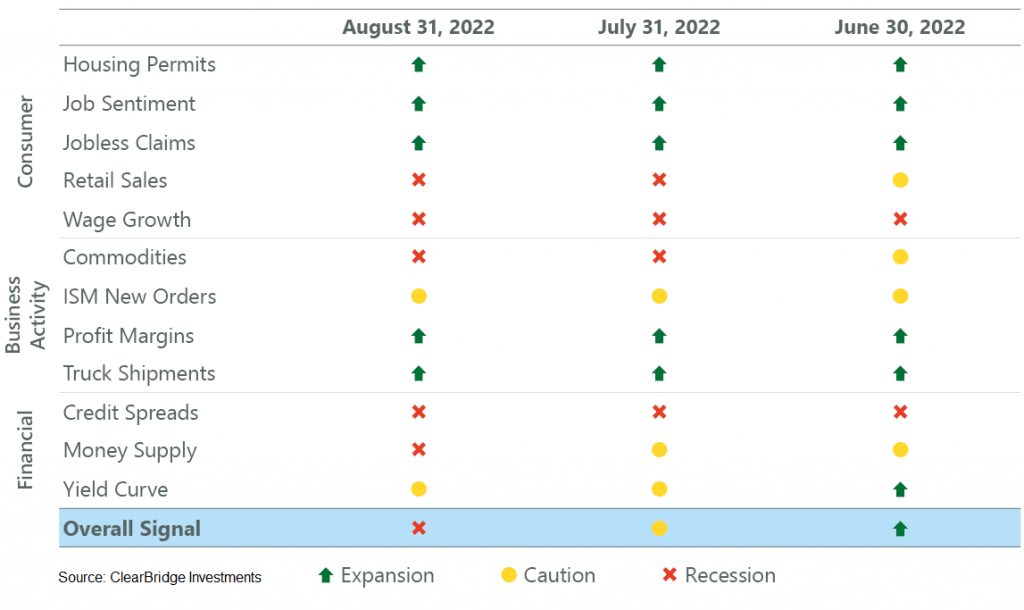

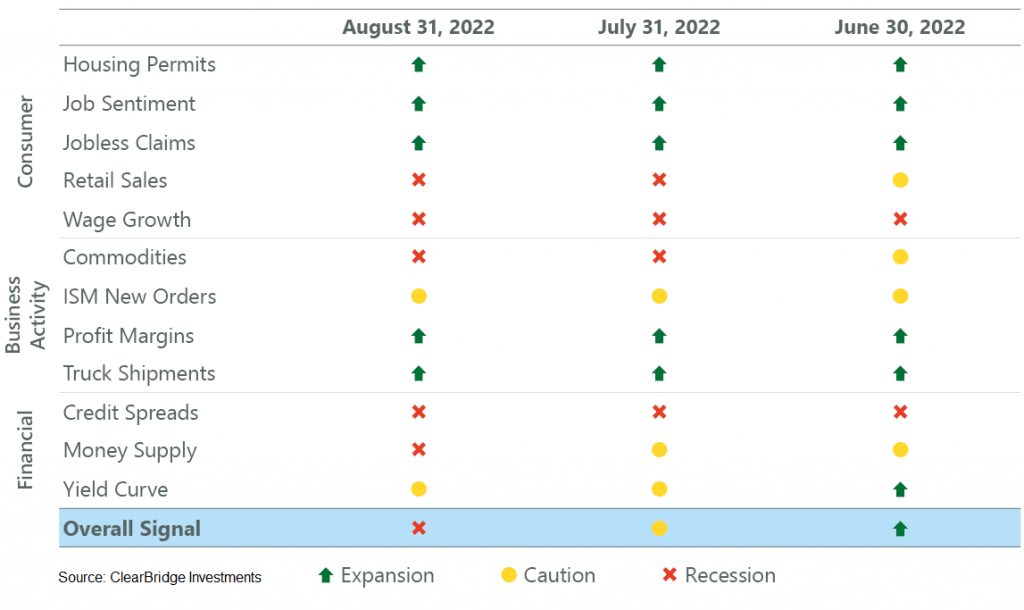

Economic history tells us that every time the United States begins increasing interest rates a recession follows afterwards more than 50% of the time.

The United States is now in its 14th interest rate increase cycle during the past 70 years and the question being asked is whether a recession will follow in the United States.

GDP (gross domestic product) in the United States has now declined for two consecutive quarters which is usually cited as the definition for a recession.

Click for chart.

However, Jerome Powell, the Chair of Federal Reserve of the United States is saying that a recession is not coming because of the consistently strong job growth, historically low unemployment and solid growth in consumer spending which is why the increase in interest rates is required, to slow down the rate of inflation.

The key to remember is that if a recession does follow in the United States and or subsequently in Australia then it will become an even better time for investors to buy more quality asset at a discounted price.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.