6 Dec 2022

Efficient Market Hypothesis: Risk verses Return

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

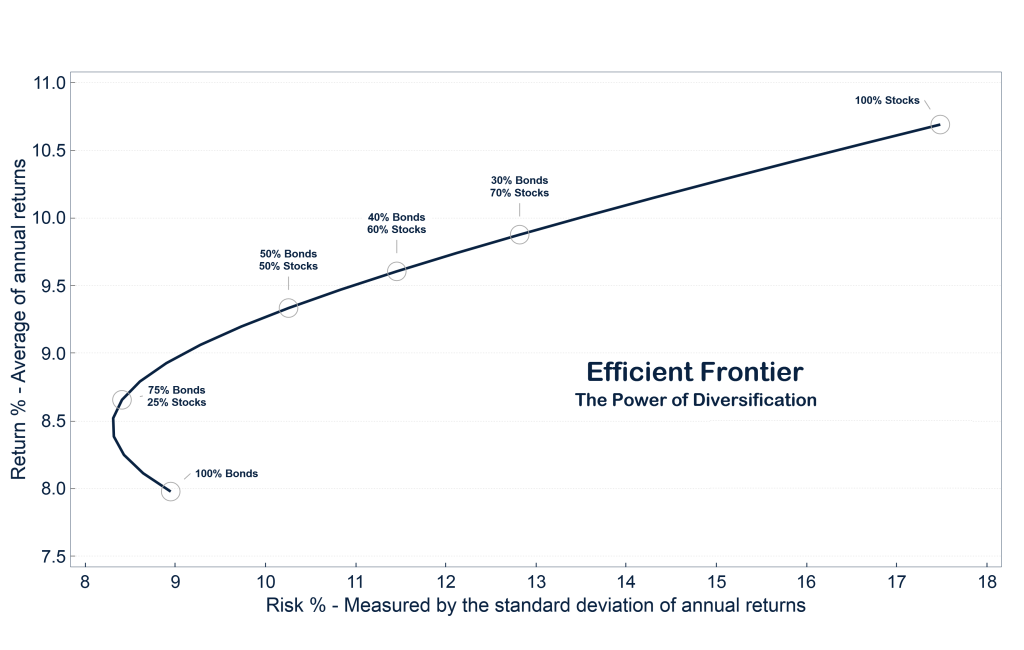

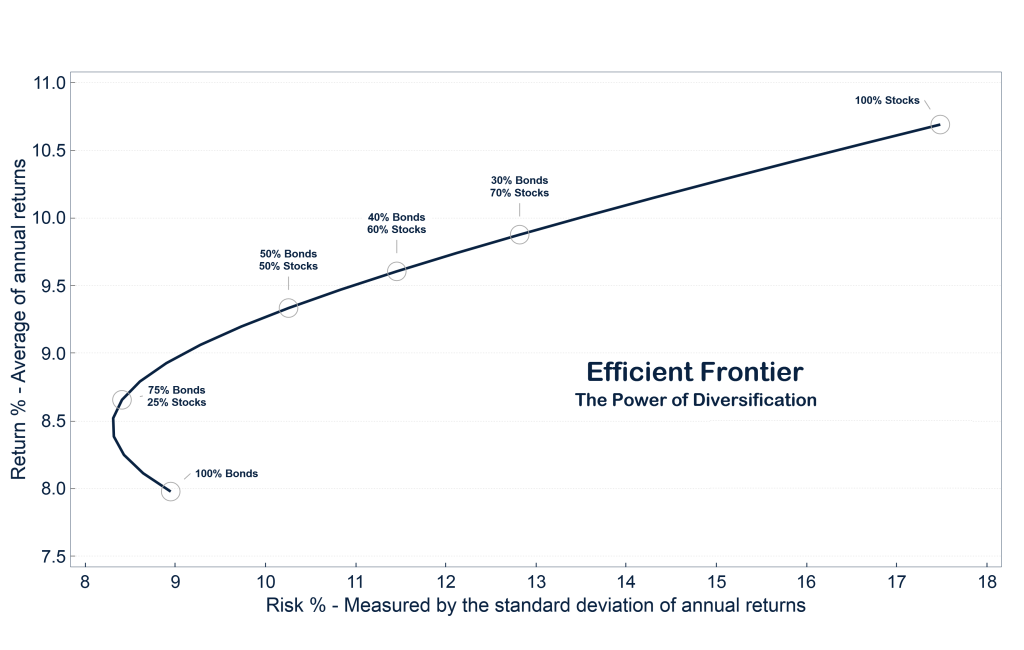

The Efficient Market Hypothesis (EMH) or Theory states that share prices reflect all information.

Meaning that listed companies are always trading at their fair market value in theory which is why index investing can work.

Using EMH, the attached is forecasting that the efficient market frontier is moving up and to the right in 2023 because of the fall in asset prices during 2022.

If the theory is correct, expect better returns but with more volatility in 2023.

Click for chart.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.