17 Aug 2023

US Interest Rates: How much higher can rates go?

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

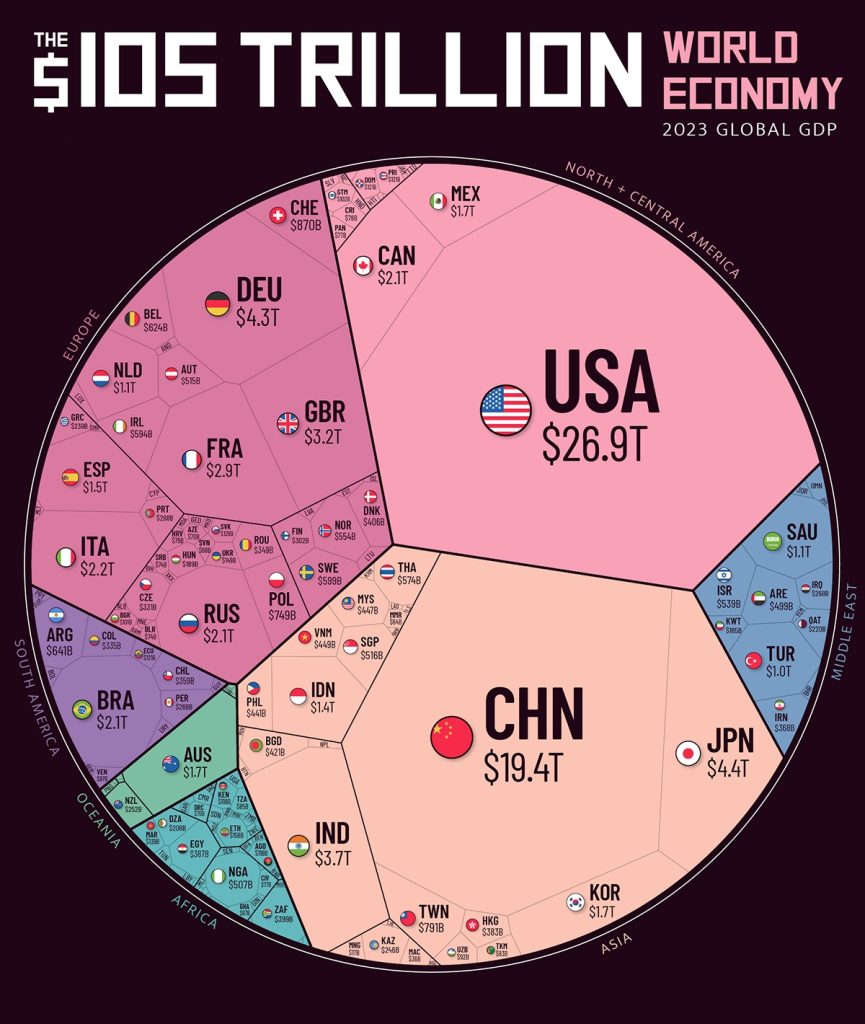

The World GDP (Gross Domestic Product) now exceeds US$105 trillion is the United States is still number one at US$26.9 trillion with China a distant second at US$19.4 trillion.

This is why the United States remains the reserve currency.

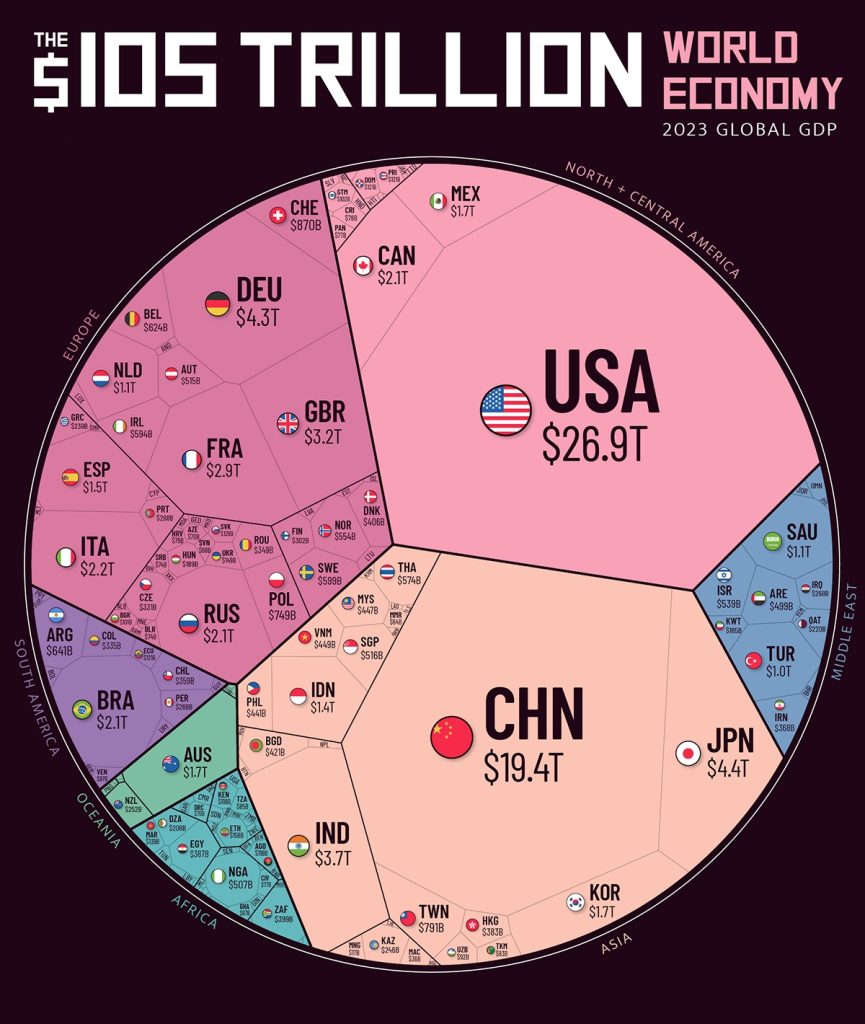

The US 10 year bond yield has moved up from 0.54% in March 2020 to 4.28% today however it remains difficult to see US 10 year bond yield rising back to pre-GFC (Global Financial Crisis) levels of 6.00% to 8.00%.

Why, because of the size of US debt which is approaching US$33 trillion and acts as a go slow on ising interest rates.

Click for chart.

Put simply, the United States is awash with debt and to rapidly take the US 10 year bond yield back to 6.00% to 8.00% would collapse asset prices.

As Benjamin Graham taught, remain invested according to your appetite for volatility and if bond yields pushing upwards cause fear and panic to take hold, then react by buying more quality assets at discounted prices.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.