25 Sep 2023

Market Metrics: EPS

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

The numbers keep supporting a slow down for the Australian economy.

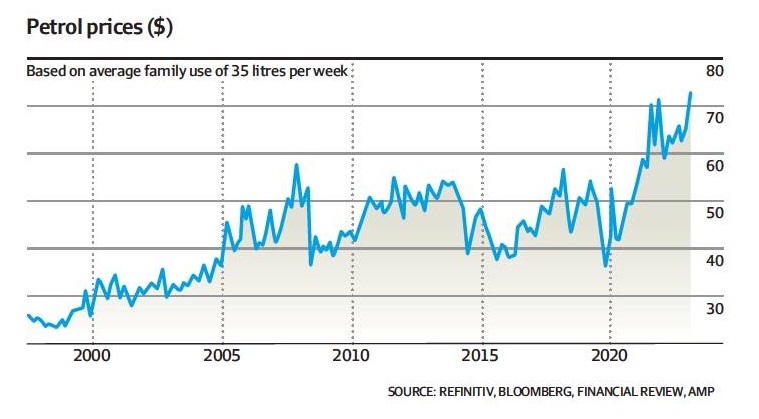

The chart above tracks the weekly cost of filling up a vehicle which is at record levels which negatively impacts on surplus disposable income for other spending.

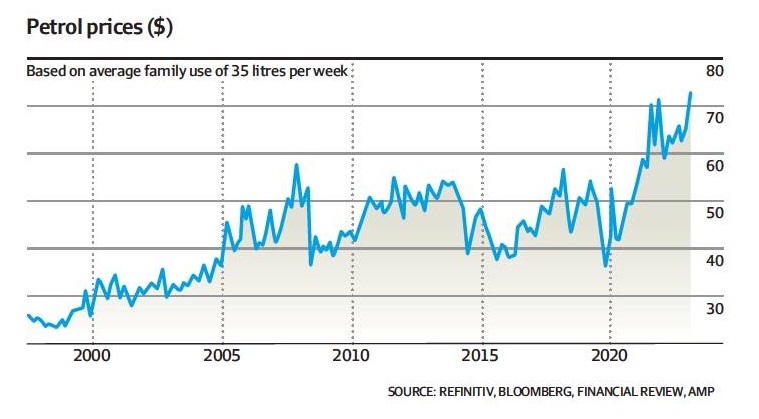

For business it is all about EPS (earnings per share) growth which is a measure of a company’s profitability and calculated by dividing a company’s net income by its number of shares outstanding.

We want EPS to grow.

However with consumers spending less widely, EPS growth is forecast to slow into 2024.

Click for chart.

As Benjamin Graham taught, there is nothing that we can do about economic cycles which is why remaining invested according to your appetite for volatility is key and when panic takes hold, react by buying more quality assets at discounted prices.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.