19 Nov 2019

Life Insurance: TPD

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

TPD stands for Total and Permanent Disability and it is employment related. There two common definition types for TPD insurance.

Any Occupation TPD insurance means you can claim if you are totally and permanently disabled and can’t work in any occupation that you are suited to by education, training or experience.

While the best definition is Own Occupation TPD insurance which means you will receive a payout if you are totally and permanently disabled and are unable to work in your usual occupation or chosen field of employment.

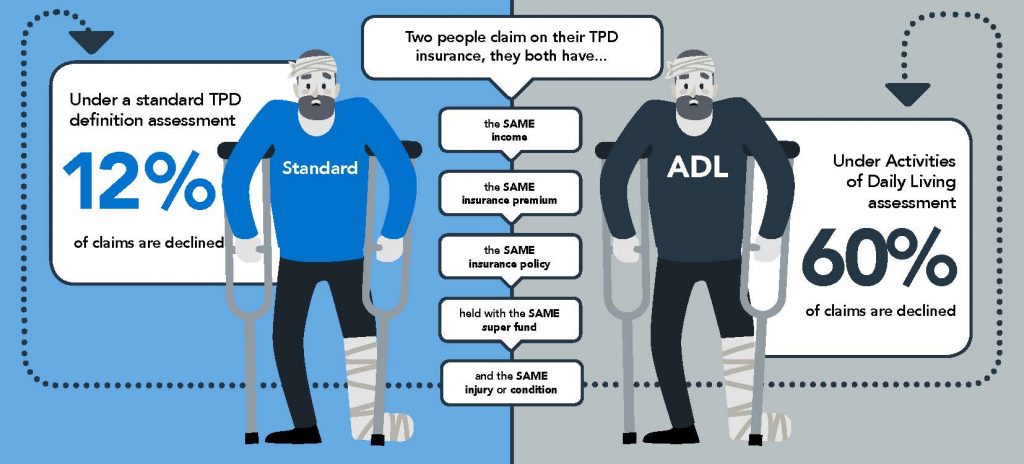

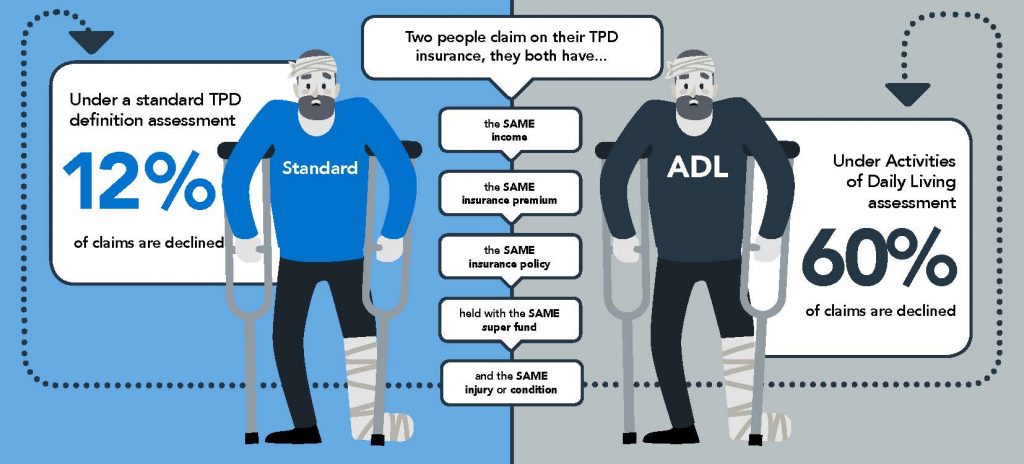

Unfortunately the only type of lump sum disability insurance that can be owned within superannuation is the Any Occupation definition or the even less favorable ADL (activities of daily living) definition which is where you are unable to do two things such as feeding, bathing, dressing or looking after yourself for a successful claim.

The point is that TPD insurance in superannuation is worse than bad with declined claims rates as high as 87%.

TPD insurance is a $3.5 billion annual premium business involving 13.4 million consumers and ASIC has finally undertaken an investigation into TPD claim payouts. The results are poor due to the TPD definition being applied by life insurance companies.

If you have any questions or need help please call us 02 9267 2322 to book in a time.

Click for report.

Click for declined claim rates.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.