5 Mar 2020

Market Metrics: Correction verses Crash

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

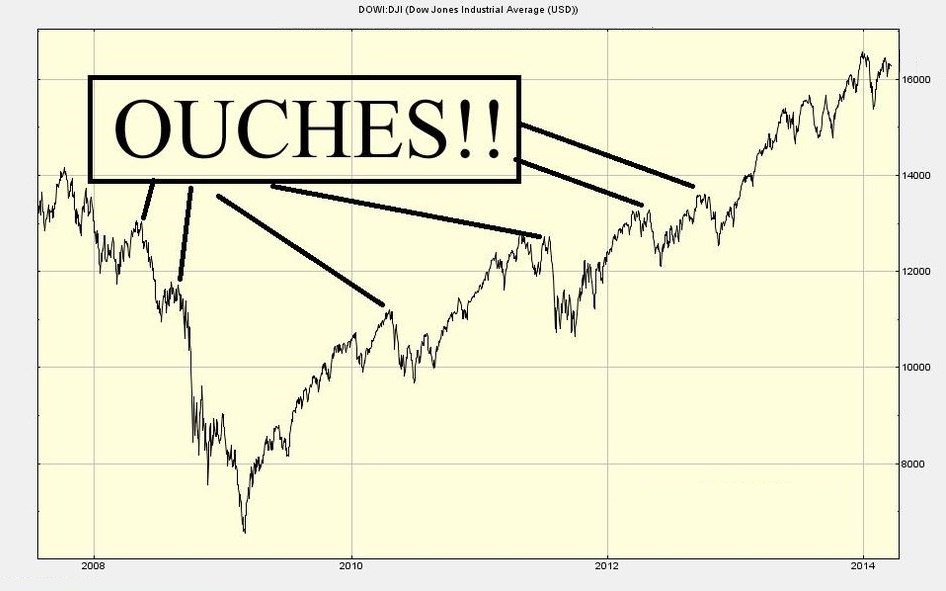

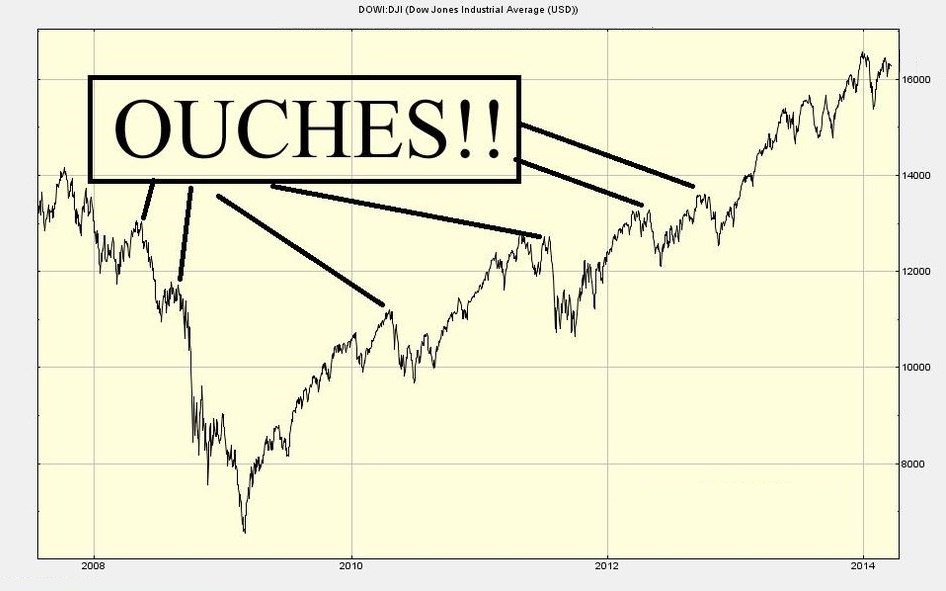

Interestingly there have been three major corrections defined as a 10% fall or more from recent peak since the Global Financial Markets (GFC) crash in 2008.

There was 2011 when US lost its AAA credit rating, 2016 when the purchasing managers index (PMI) in China dropped below 50 and 2018 when Trump launched his tariff war on China and then the rest of the World.

All three corrections did not devolve enough to become a financial markets crash which is defined as a 20% fall or more from recent peak.

The current COVID-19 event is most definitely a correction as confirmed by the Down Jones Industrial Average having fallen 14.1% but it has already rebounded from that low.

Click for charts.

Will this fourth attempt win out and crash financial markets? Don’t know.

However what we do know is that when Mr Market is offering a 10% discount that is an opportunity to add to your investment portfolio even if the fall were to continue into a financial markets crash.

WARNING, this does not constitute Personal Advice and to discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.