12 May 2021

2021 Australian Federal Budget

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

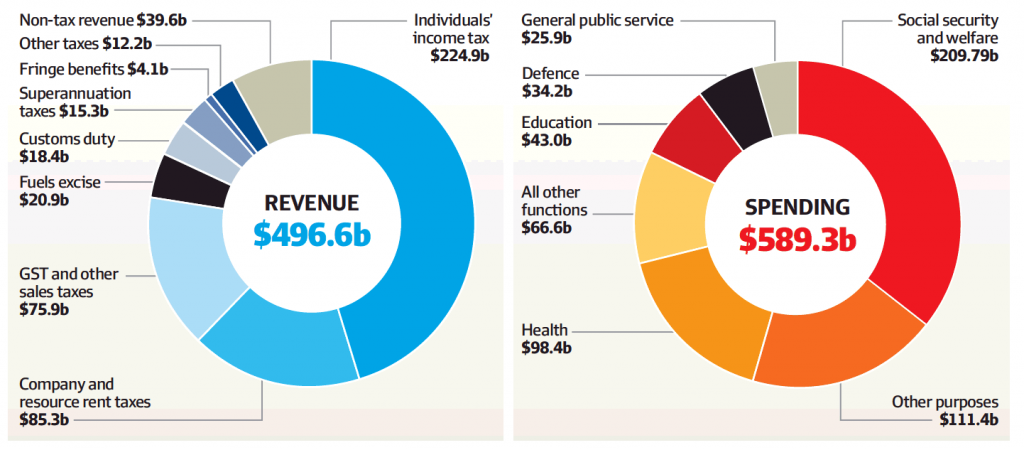

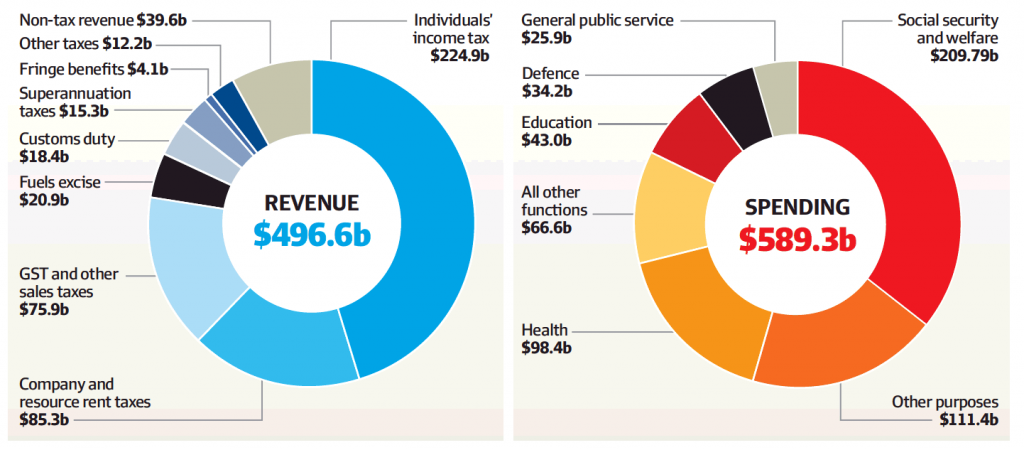

The Federal Treasurer Josh Frydenberg has handed down his third Budget with big spending for women, single parents, families, first home buyers, disabled Australians, retirees, worker, aged care and airlines plus airports.

A couple of key opportunities include-

- Removal of the Work Test from 1 July 2022– Individuals up to the age of 74 years will be allowed to make or receive non-concessional or salary sacrifice super contributions without meeting the Work Test.

- Downsizer contribution from 1 July 2022– The minimum age requirement for the downsizer contribution will reduce from 65 to 60.

Have a question, given all this spending in excess of revenue, who exactly is going to repay this ever increasing Federal Government debt?

It is important to remember that these Budget announcements are still only proposals and will still need to be legislated.

Click to read.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.