31 Aug 2018

Index Returns

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The debate over passive versus active investing has been raging for decades.

Passive investing is focused on reducing cost by holding all the assets in the index in proportion to their current market value while active investing is focused on producing a net after fees return in excess of the index.

Which is best? Active.

Provided that you invest with the right professional managers. For example, Warren Buffett and Charlie Munger have been Portfolio Managers for Berkshire Hathaway Inc which has delivered a 19.1% compound annual rate of return net of fees over 52 years versus the S&P 500 index which has returned 9.9% for the same period (see table).

Double the index return after fees is a great win for investors.

Interestingly, index returns have been falling for a number of years. For example, Australian shares have fallen from 12.0% per annum to 9.1% per annum in compound rate of return over 30 years to 30 June 2018 versus 30 June 2012. This is a 24% decline in the compound rate of return from 2012 to 2018 (see charts).

Why? Falling interest rates.

The 30 years to 30 June 2012 compound rate of return had interest rates in high double digits in the starting 10 years while for 30 June 2018 the interest rates had already dropped.

Falling interest rates have been a core driver for growth assets prices (property, shares) and defensive asset prices (bonds) over the past four decades.

The problem however is that interest rates have now stopped falling which is bad news for growth assets prices (property, shares) and defensive asset prices (bonds) and makes the return from passive investing even less attractive.

In addition to rising interest rates going forward, let’s also not forget to throw in the odd financial catastrophe which will cause fear and panic and present investors with the best opportunity to buy even more quality assets at reasonable or better still discounted prices.

WARNING, past performance is no guarantee of future performance and the above does not constitute Personal Advice.

22 Aug 2018

Education: Kids & Money

- Posted by Dejan Pekic BCom DipFP CFP GAICD

How do you educate your children about money without handouts?

The problem with just giving money to your children is that there is the real possibility of ruining them financially as adults.

We have linked a research paper about the Invisible-Money Generation which is about how money for children no longer exists in just the form of paper and coin.

For example, V-Bucks are used in Fortnite as currency to purchase items.

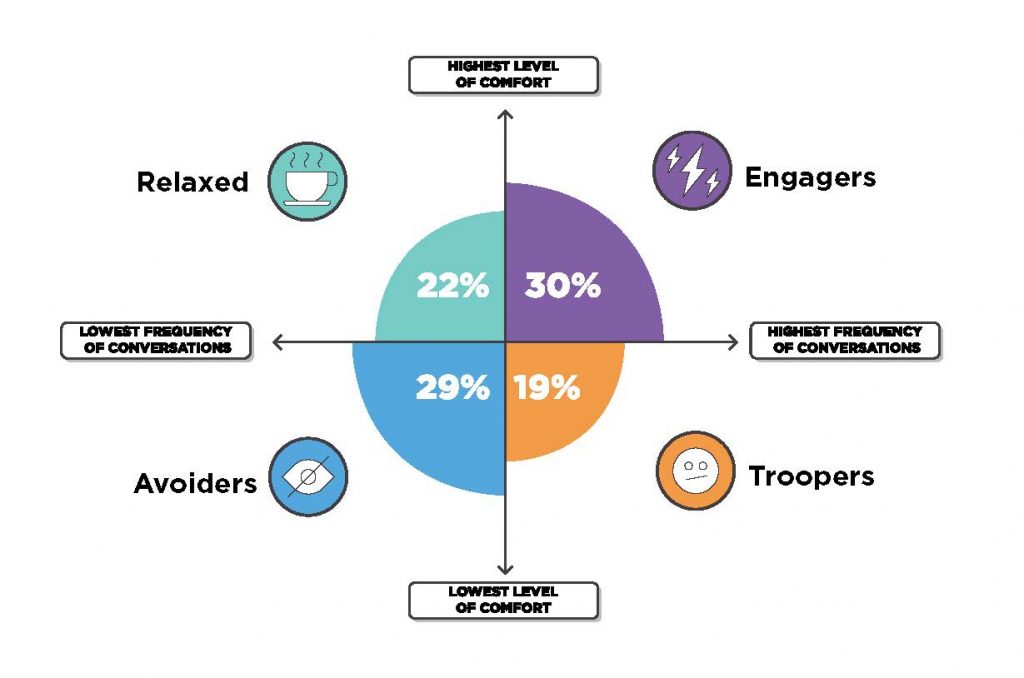

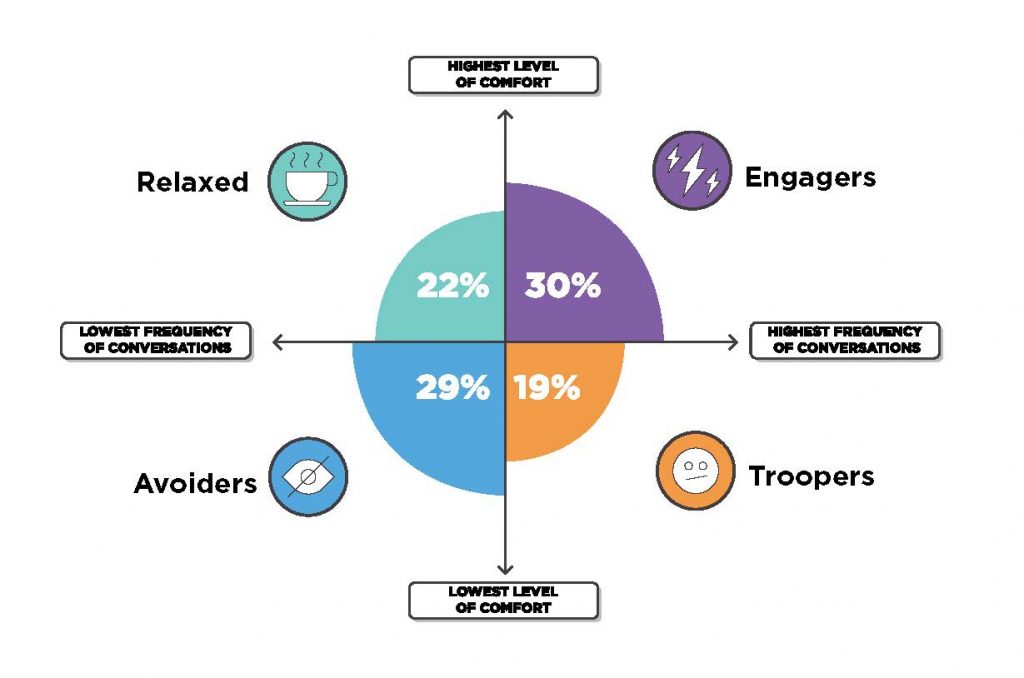

The purpose of the research is not to alienate our children from the evolution of money but to help us as parents understand our own attitude towards money (whether relaxed, engagers, avoiders or troopers) so that we can educate our children about money.

This is not easy.

Click to read.

16 Aug 2018

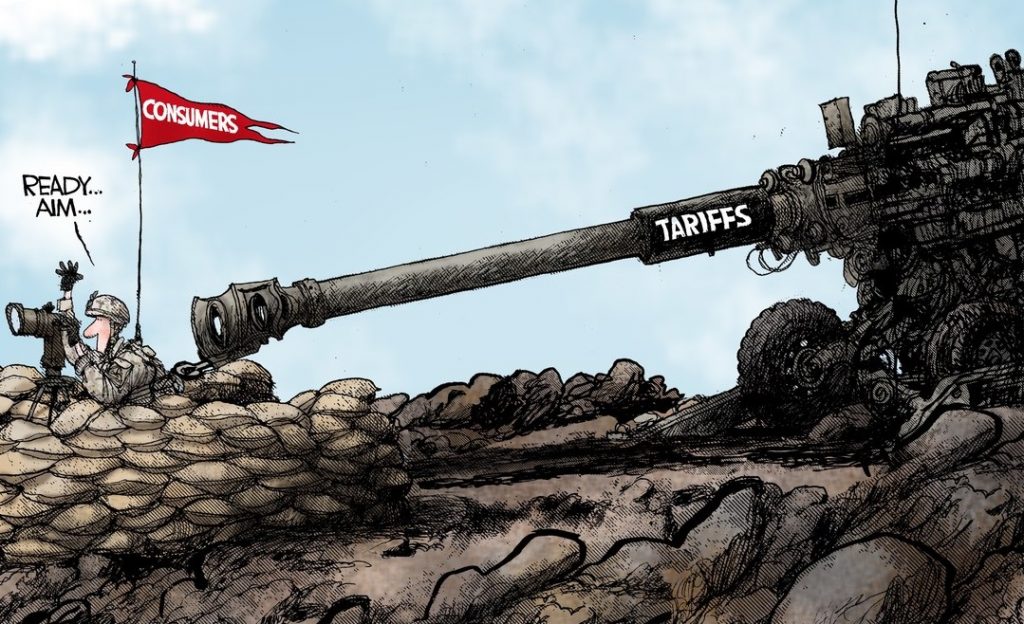

US China Trade War: Tariffs

- Posted by Dejan Pekic BCom DipFP CFP GAICD

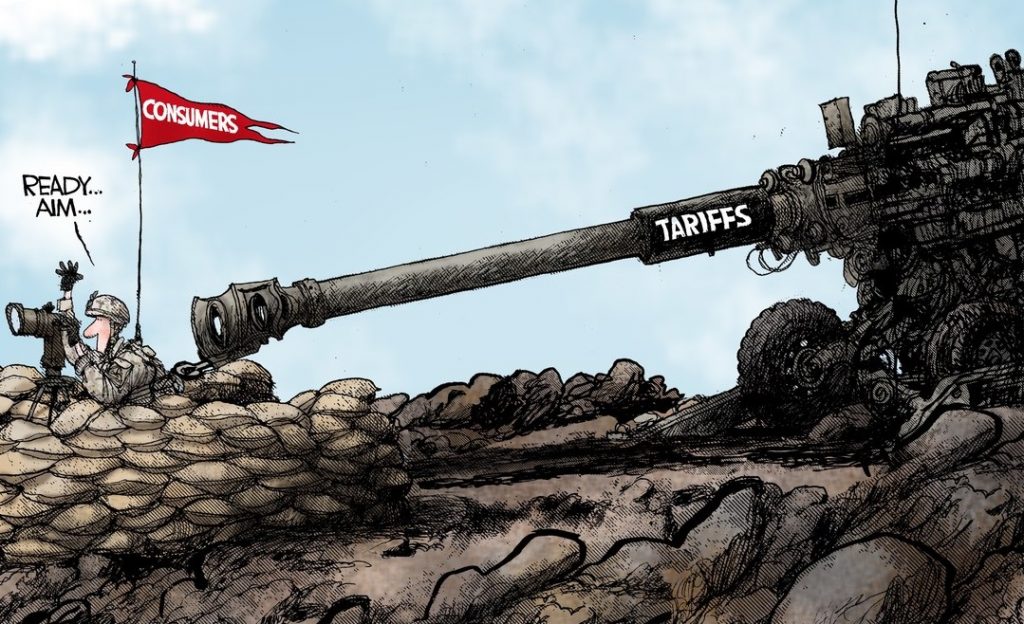

Tariffs sound like a good idea, protect domestic business, protect domestic jobs but history proves that they are a bad news.

Everybody loses.

The attached research piece shows the impact of the 1987 introduction of direct import tax on the United States and the impact of the 1997 and 2014 consumption tax on Japan.

For both, inflation rises, spending falls and GDP plummets.

Tariffs are one more indicator that we are coming to the end game in the current cycle and so remember, when fear and panic take hold during the next financial catastrophe, investors will be presented with the opportunity to buy more quality assets at discounted prices.

Click to read.

9 Aug 2018

The Wisdom of Great Investors: 7 insights

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Kerr Neilson is one of Australia’s very best PM (Portfolio Managers) and here he shares 7 insights on successful active investing. He also is one of Australia’s billionaires.

What you need to know to invest-

- Think about how the world is likely to be

- It is the competitors response that matters most

- Learn to deal with the media overload

- Anchor decision on fact, not momentum

- Be aware of limitations of financial modelling

- Great investors continually build their knowledge

- Humility

Knowing this, just remember that it is when fear and panic take hold that an investor is presented with the best opportunity to buy more quality assets at reasonable or better still discounted prices.

Click to read.

8 Aug 2018

World Population Growth: Numbers

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Yesterday, the 7th August 2018 Australia’s population reached and passed 25 million residents.

History tell us that Australia was first discovered by the Aboriginals, then by the Dutch in 1606 and then by Great Britain when James Cook landed in 1770 and the subsequent establishment of the penal colony of New South Wales on the 26 January 1788.

It has taken 230 years to reach 25,000,000 residents.

In terms of total global population which is around 7,635,000,000 Australia’s numbers are a minor, not insignificant but minor.

The more interesting story is how will population numbers and the scarcity of natural resources play out over the next 3 decades as global population numbers rise to a forecast 9.4 billion individuals?

Click for top 10 countries with highest population.

2 Aug 2018

Australia’s most trusted brands

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Trust, like reputation takes years to build but it can be lost in an instant.

The attached piece lists Australia’s top 10 most trusted and top 10 most distrusted brands.

The surprise, our two major supermarkets are both listed in the top 10 most distrusted.

Trust is not hard, it just requires the business to repetitively keep doing the right thing. If you focus on being fair and reasonable towards the client/customer, everything else will follow.

However, let’s please not confuse trust with political correctness because political correctness gone unchecked can easily result in even greater levels of distrust for the business.

Click to read.