17 Jun 2022

Market Metrics: Australian All Ordinaries Index

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

Jerome Powell, Chair of Federal Reserve of the United States increased official interest rates by 0.75% this week to aggressively cool a ‘very hot’ American economy.

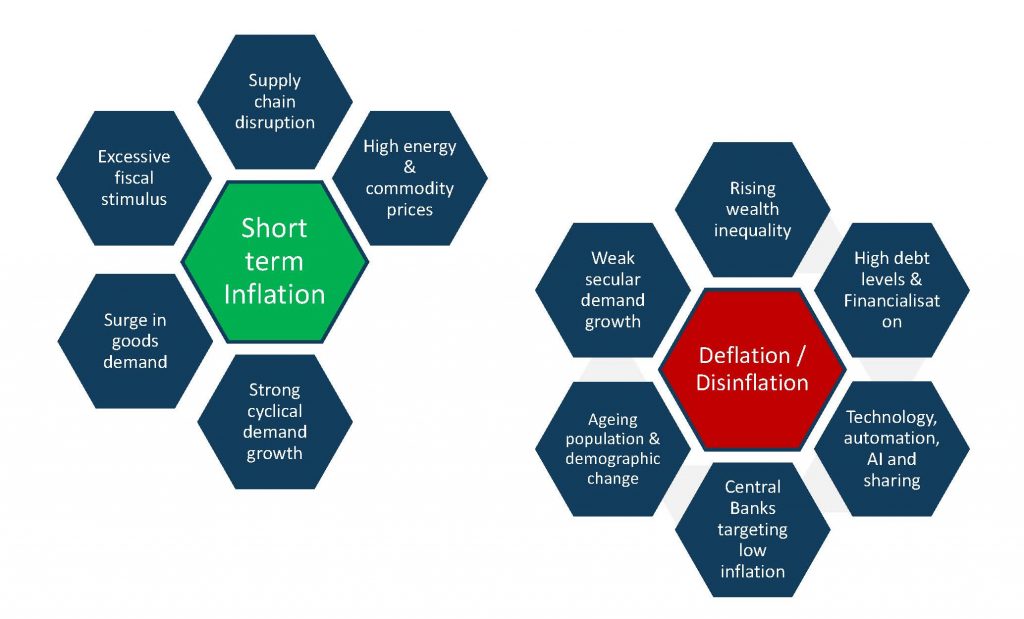

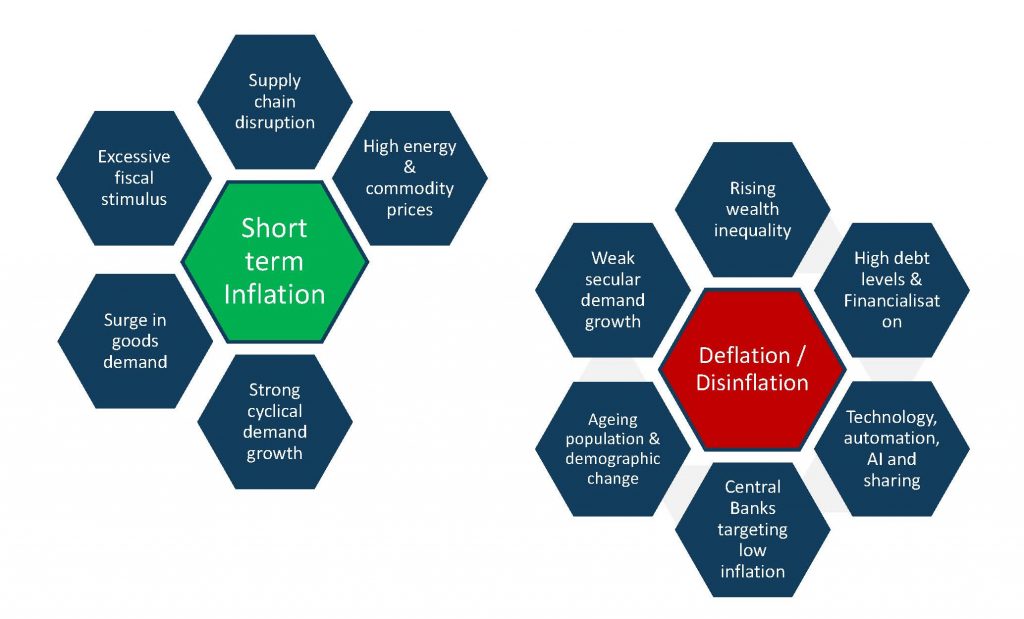

The current short term issue is inflation which is due to supply chain shortages, higher energy/commodity prices and lots of money printing.

However don’t think that the deflation issue has disappeared.

The World still has in excess of US$300 trillion in debt, an aging population and rapid technological automation which sets the World for deflation or low growth over the medium to long term.

If we look back at the Australian All Ordinaries Index over the past 50 years there is a clear message.

No matter the economic challenge, if you do not panic and sell when asset prices have corrected or crashed you are extremely likely to double your investment over any 10 year holding period.

Click for chart.

The current correction in asset prices both in Australian and internationally is sending us a clear message, now is not the time to sell, instead it is the time to remain invested according to your appetite for volatility and continue to buy more quality assets at discounted prices.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.